🧭 Why I’m Sticking to the Monday/Tuesday Plan in September

Last month, I often found myself re-entering new trades after locking in small profits early in the week. While that worked well, it led to more screen time, scattered entries, and potential overtrading.

In contrast, September will be different:

- ✅ Only 2 trades per week: Monday and Tuesday entries in the last hour of trading, per my automation script.

- 🧠 No chasing wins: Let the law of large numbers play out. Stop-losses are part of the system — I must embrace them.

- 💪 No emotional reactions: I’ll aim to remain neutral regardless of whether a trade ends in profit or loss.

📊 Why I’m Confident — 3 Years of September Backtest Results

Over the last three Septembers, my 2/7 DTE Double Calendar strategy has delivered:

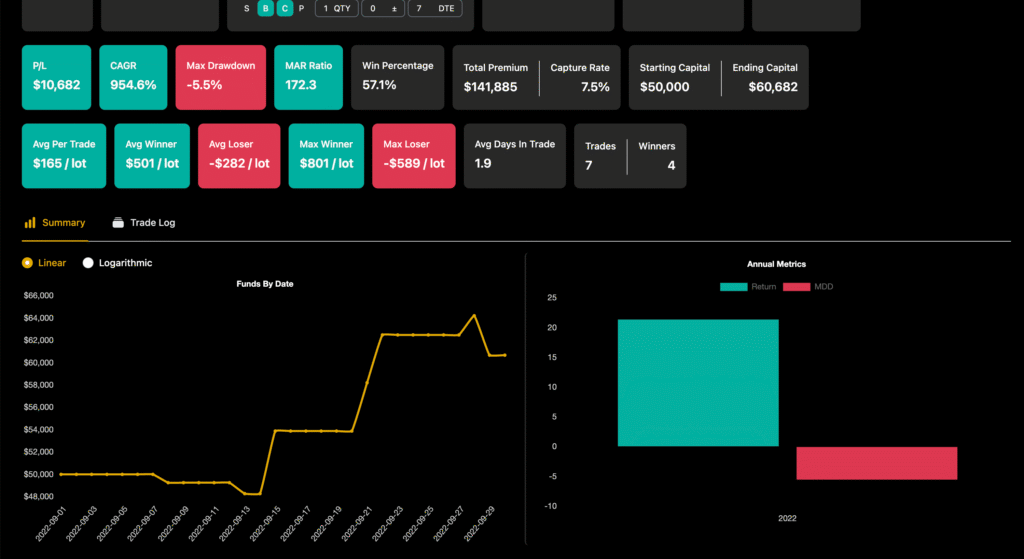

2022

- 🟢 P/L: $10,682

- ✅ CAGR: 954.6%

- ✅ Win Rate: 57.1%

- 🔻 Max Drawdown: –5.5%

- 🔹 Total Trades: 7 (4 winners)

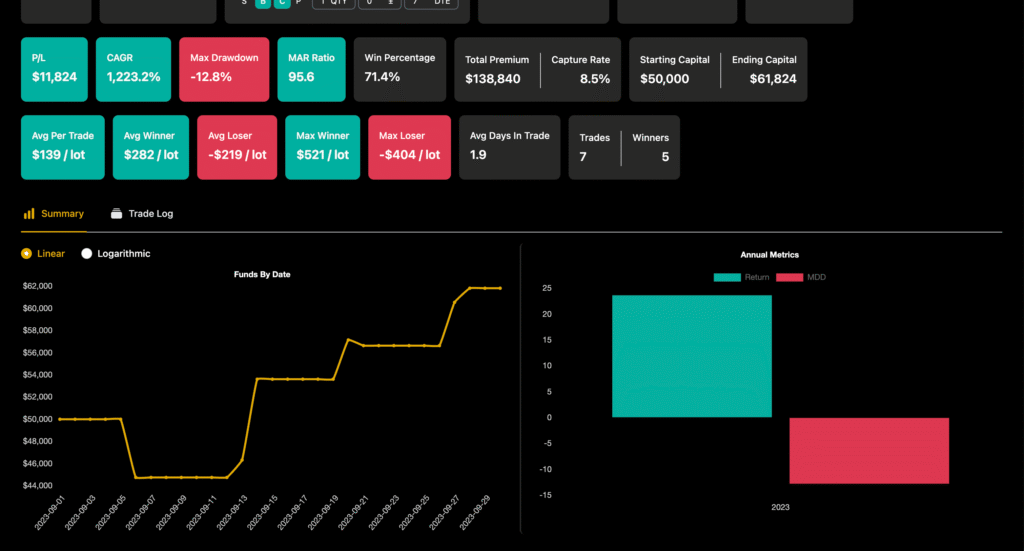

2023

- 🟢 P/L: $11,824

- ✅ CAGR: 1223.2%

- ✅ Win Rate: 71.4%

- 🔻 Max Drawdown: –12.8%

- 🔹 Total Trades: 7 (5 winners)

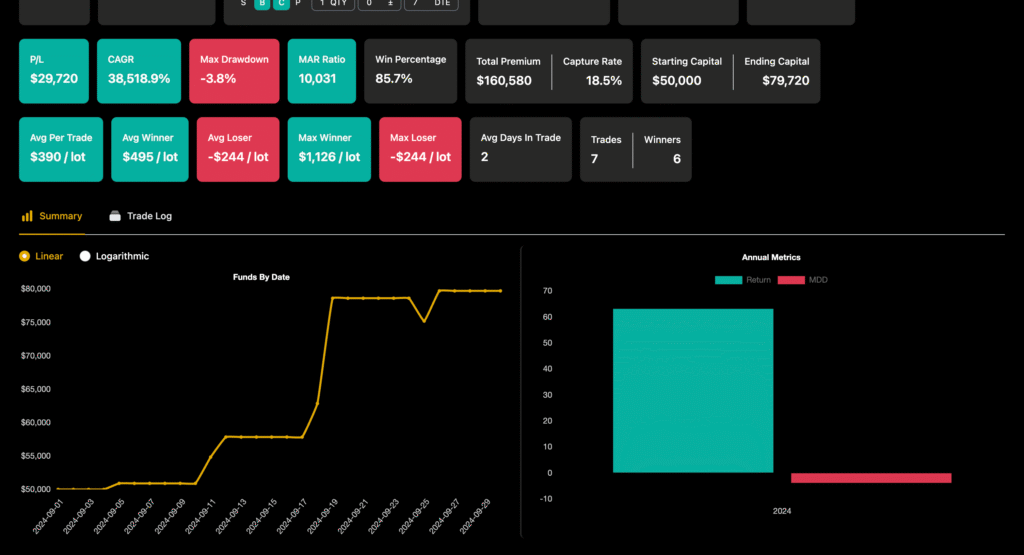

2024

- 🟢 P/L: $29,720

- ✅ CAGR: 38,518.9%

- ✅ Win Rate: 85.7%

- 🔻 Max Drawdown: –3.8%

- 🔹 Total Trades: 7 (6 winners)

🔎 So What’s My Risk If 2025 Is Different?

If this September turns out to be the worst of the last 3 years, here’s what that would look like:

- 📉 Max Drawdown (from 2023): –12.8%

- 💸 From $50,000, a drop to ~$43,600

- 🧠 Still manageable given the long-term plan

This is well within my risk tolerance. It’s critical to zoom out and focus on the bigger picture, not individual trades.

🧠 Final Thoughts

📈 I believe in this system.

🔁 Backtests aren’t guarantees, but they’re better than guessing.

🧮 Consistency > Emotion.

⚖️ Stick to the rules. Accept the losses. Celebrate the discipline.

Let’s see how this September plays out.

⚠️ Disclaimer

The information presented in this blog post is for educational and informational purposes only and is not intended as financial or investment advice. I am not a licensed financial advisor. All trading strategies discussed reflect my personal experience and are not recommendations to buy or sell any security or derivative.

Trading financial instruments such as options, futures, or stocks involves significant risk and may not be suitable for all investors. You should conduct your own research, consider your financial situation, and consult with a licensed financial advisor before making any investment decisions.

Past performance is not indicative of future results. Use of this information is at your own risk.